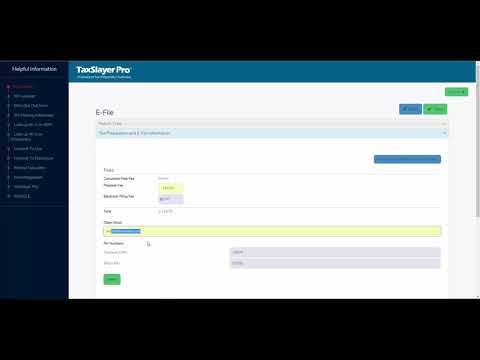

This is probably the most important part of the program. At this point, we're going to electronically file the return and make sure that you, as a preparer, get paid for your work. So, here at the e-file screen, I'm going to select the federal return type. In other words, how does the taxpayer wish to receive his or her refund? If I click on the drop-down, you'll see that I have some choices here. Anything with the abbreviation for one of our banking partners, or in my case, refund advantage, in front of it means that I'm adding a bank product. My fees will be subtracted from the client's refund. If I don't add a bank product, I'm going to select electronic mail here and click Save. Then, this warning message pops up. We've had preparers and clients who bypass this message, thinking that they were adding a bank product in order to collect their fees later. They have been sorely disappointed. This return is not a bank product. You should collect your fees before filing the return. Remember, I marked it as an emailed check. So, I'm going to close this warning message and we'll go back. Instead of electronic mailed, I'm going to choose refund advantage check print ERC. So, I'm going to click Next. Here, our preparer fees would pop up. If I had preparer fees entered in my configuration, they would automatically pop up. What I can do is I can enter my preparer fees on the fly if I wish. I can also enter my client's email, the taxpayer PIN, and the ER o--'s PIN automatically fills. I can click Next. I'm asked how I wish to file my State returns. The return type I've selected is electronic mail for the state. But again, I could send the...

Award-winning PDF software

8879 turbotax Form: What You Should Know

If a person in your household is a beneficiary of any retirement account, such as an IRA or 401(k). Include the amount of the account as income. In some cases, it can be a good idea to include it on your individual tax return. To learn more about Form 1099-DIV, take the following steps. About your Form W-2, Wage and Tax Statement — IRS Sept 2, 2025 — Form W-2, Wage and Tax Statement, provides you with information about the wages that you earned and reported in your W-2 form. If you About your Form W-2, Wage and Tax Statement; Report to IRS Jan 20, 2025 — The form can be the backbone of determining your tax liability if you are not sure of everything you need to know. Some of its uses include: To calculate gross wages (income) for purposes of calculating taxes and withholding; to determine whether you are eligible to receive certain government benefit payments or deductions; or to report amounts you are required to withhold. What is “Taxable Income” in the US? Aug 16, 2025 — “All workers” with gross income of 75,000 or more are considered to be “taxable” in the US and must file annual US tax returns, including Schedule A (Form 1040), for the years they earned the greatest of 75,000 or more, from any source. What is “Employment Taxes”? Aug 20, 2025 — “Employers” must collect and pay social security, Medicare, unemployment and/or workers' compensation and other government-required benefits. To learn more about “Employment Taxes,” take the following steps. About Wage and Tax Statement. — IRS Oct 3, 2025 — The Form W-2 gives you information about your job earnings and pays taxes to the IRS. Form 1099-DIV — Tax Act Sept 27, 2025 — This form is used to report gains, losses or deductions, whether through a trust, partnership or corporate trust, of any source, not for the year in question, which are not paid or reported in your Form 1099-DIV. Your tax return for the year that includes any gain from the sale of shares of a company or a partnership you own (a “partnership item”) or from the sale of property is based on the partnership item, and you receive your distribution from that partnership item.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8879, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8879 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8879 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8879 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8879 turbotax